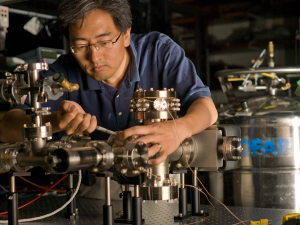

Scott Zoldi, PhD 1998, is Vice President of Analytic Science at FICO

After getting a PhD in physics at Duke in 1998 and earning a Director’s Postdoctoral Fellowship at Los Alamos National Laboratory, Scott Zoldi is now Vice President of Analytic Science at FICO (Fair Isaac Corporation) in San Diego, California. “When I was at Duke this was not my first view of where I would end up,” he says, “but it’s actually a natural place for theoretical physicists.”

What links all his work together is computational analytics. “Working with data and trying to understand complex systems and relationships in data has been a continual passion and interest to me,” he says. With Prof. Henry Greenside, Zoldi used computational science and computer simulation to study complex systems such as weak turbulence and chaos. He won a DOE computation science graduate fellowship that helped pay for his education at Duke and allowed him to do research in the summers at Los Alamos National Laboratory, where he later got a Postdoctoral Director’s Fellowship. At Los Alamos, he used simulation and computation theory to advance computational methods with implications to numerical simulations of the behavior of the nuclear stockpile. In particular, he explored numerical shadowing theory, which relates to identifying the limits of computer simulation. At FICO, he manages a team of more than 50 scientists, who analyze data with the goal of detecting and preventing credit card fraud and preventing breaches of financial networks. “I continue to hone and develop my analytic skills and continue to ask fundamental questions about physical laws of dynamical systems and those patterns in the data that would indicate whether or not a credit card is being used suspiciously,” he says. “We have a data consortium that comprises 65% of the world’s credit and debit card transactions,” he says. “We have all this data—so the question is how do we find the fundamental laws, behaviors, or features that would allow us to make predictions about which credit card might be going fraud? What are the anomalous behaviors we want to alert financial institutions to?” He says that 17 of the world’s 20 largest financial institutions use FICO’s fraud analytics and models. “My team is responsible for a product that prevents hundreds of million dollars of fraud losses for banks across the world,” he says. As a vice president, he does less computer programming than he used to. He focuses on making sure the team is doing things correctly from an analytics perspective, with the help of three of his directors, two of whom are also physicists. “We have to ensure that the analytics are predictive and also robust and stable,” he says. He also mentors the scientists on the team, and works closely with clients to get inspiration for the development of new analytic innovations. He’s authored more than 30 patent applications for FICO. Zoldi grew up in Maine and majored in engineering physics at the University of Maine. He was attracted to Duke, he says, because “I was impressed with the work that Henry and others were doing in the Center for Nonlinear and Complex Systems, and particularly Henry’s focus on numerical simulation.” In his free time, he enjoys spending time with his family, which includes a 22-year-old stepdaughter and a two-year-old son. He’s also a sports car enthusiast and likes to relax by taking his weekend car out for a spin and enjoying sunny Southern California.